HAL Q1 FY26 Results: Margin Surge Amid Mixed Profit

Robust Revenue, Expanding Margins, and a Dynamic Order Book Signal HAL’s Resilience Despite Profit Dip

Introduction: Strong Start to FY26 for HAL

India’s premier aerospace and defence manufacturer, Hindustan Aeronautics Limited (HAL), kicked off FY26 with a quarter that showcased revenue strength and enhanced operational efficiency, offset by marginal decreases in net profit. This performance has underlined HAL’s status as a cornerstone of India’s defence sector while illuminating both opportunities and headwinds in a fast-evolving environment.

Financial Headlines: Revenue Up, Margins Broaden

During Q1 FY26 (April–June 2025), HAL reported:

• Consolidated revenue from operations surging 10.9% year-on-year to ₹4,819 crore, driven by the execution of projects from its substantial ₹1.89 lakh crore order book and strengthened by a higher contribution from repairs and overhauls.

• EBITDA margin climbed significantly to 26.6% (up from 22.8% a year earlier), aided by improved operating leverage.

• Operating profit (EBITDA) soared almost 30% to ₹1,284 crore, surpassing analyst forecasts and reflecting growing scale.

• Consolidated net profit came in at ₹1,377 crore, a 4% dip from the same quarter last year, primarily attributed to higher tax outgo and increased employee expenses.

Order Book and Execution: Building for the Future

HAL’s order book—one of the largest in India’s defence industry—stood at a staggering ₹1.89 lakh crore by the end of Q1 FY26, providing long-term revenue visibility. Management reaffirmed guidance for:

• The company is aiming for an order book of ₹2.5–2.6 lakh crore by FY26, supported by strong execution as indigenous defence contracts gain momentum.

• Delivery of 12 LCA Mk1A fighter aircraft this year—a step-change from past fulfillment rates, thanks to streamlined supply chains and key technology partnerships.

Stock Market Reaction: Bullish Despite Near-Term Dip

• HAL’s shares recovered from initial losses and gained over 2% after the results announcement, outperforming the Nifty index and demonstrating investor confidence in the company’s underlying momentum.

• Brokerages have largely maintained bullish positions. Notably:

o Motilal Oswal, Nomura, and Nuvama have set target prices between ₹5,800 and ₹6,100 per share, projecting an upside potential of up to 38%.

o Stronger margins, execution discipline, and a sizable order pipeline were cited as key drivers behind these optimistic forecasts.

Margins and Capital Efficiency: The Standout Story

While profit slipped marginally, HAL’s margin story took center stage:

• EBITDA margin expanded by nearly 400 basis points, surprising analysts and signalling improved cost efficiency.

• The company managed this margin expansion even as employee benefit costs rose due to higher pension scheme contributions.

• HAL remains almost debt-free, providing further financial flexibility as India steps up defence indigenization and multi-year procurement cycles.

Sectoral and Strategic Context

HAL’s strong revenue and margin performance comes as India seeks self-reliance in military hardware and boosts domestic procurement. The company’s execution on current orders—especially the Tejas fighter program and helicopter fleet upgrades—have increased its strategic importance.

Analysts believe HAL is well-positioned to capture an even larger share of upcoming military aviation contracts, particularly as budget allocations and geopolitical priorities focus on domestic manufacturing and assembly capabilities.

Challenges and Key Watchpoints

Despite its robust performance, HAL faces several challenges:

• Sustaining profit growth amid rising costs, especially with new pension obligations and higher tax outgo in Q1 FY26.

• Delivering complex aircraft and systems on schedule while maintaining quality, given the scale of pending orders.

• Navigating global supply chain headwinds as it ramps up the Tejas Mk1A and other key programs.

Conclusion: HAL Remains a Defence Powerhouse

Q1 FY26 results reinforce HAL’s leadership in India’s defence sector, with revenue and margins hitting record highs despite a dip in net profit. Supported by a massive order book, execution discipline, and strong institutional backing, HAL is primed for further growth and strategic prominence. Most analysts recommend holding or accumulating the stock, anticipating stronger profits as project deliveries accelerate and costs are further optimized.

.

:

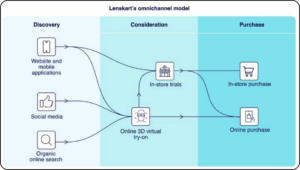

The image added is for representation purposes only