The FII turnaround: What’s behind the ₹3,000-crore inflows into Indian equities?

In the first half of October 2025, the Indian equity markets witnessed a sharp reversal in foreign institutional investor (FII / FPI) flows. Over just seven trading sessions, FIIs flowed in more than ₹3,000 crore into Indian equities, reversing a protracted, multi-month selling spree. On 16 October, this inflow served as a key catalyst for a rally: the Sensex jumped more than 500 points and the Nifty crossed 25,450. This sudden pivot begs several questions: what has changed in sentiment, macro or valuation? How does this compare with earlier cycles of FII exits and returns? And finally, what does it imply for volatility, valuations, and the balance of power between foreign and domestic investors?

Background: The Outflow Phase & Historical Context

* Persistent Outflows Earlier in 2025: FIIs had been net sellers for much of 2025. As per reports, by early October, cumulative foreign outflows from Indian equities had touched ₹1.98 lakh crore (i.e. ~ ₹198,103 crore) in the calendar year to date. In September alone, FIIs exited about ₹27,163 crore from equities. Between July 1 and early September, FIIs sold shares worth over ₹1 lakh crore, driven by stretched valuations, profit booking, uncertainties over U.S. tariffs and weak corporate earnings. That said, domestic institutional investors (DIIs) often offset the sell pressure, acting as contrarian buyers.

* Past Cycles of Exit and Return: Historically, FII flows in India have been volatile and procyclical: in favorable global conditions, FIIs pour in capital; but when risk aversion or external shocks appear, they rush out. Academic studies (e.g. in “Trading Behaviour of Foreign Institutional Investors”) suggest that FII equity flows display a mean-reverting nature, and are more volatile than local flows. Periods of sharp FII withdrawal often coincide with global rate hikes, tightening liquidity, or geopolitical stress. On the flip side, rebounds in FII flows have marked past equity market bottoms or renewals of optimism — especially when valuations have corrected, macro data improves, or the global liquidity regime turns favorable again.

What’s Fueling the Current Turnaround?

Several triggers appear to be aligning, making foreign investors more comfortable re-entering India. Below are some of the key factors:

1. Macro stability, easing inflation & policy room: The latest Reserve Bank of India (RBI) minutes show that inflation in India has softened, giving the central bank room for potential rate cuts. The RBI left the repo rate unchanged at 5.50% in its latest meeting but maintained a neutral stance; some members advocated shifting to accommodative. Lower inflation expectations, improved growth forecasts (GDP seen ~6.8% in 2025) and a more benign global rate environment are helping reduce the risk premium for emerging market allocations.

2. Strong IPO momentum and fresh primary market interest: October 2025 is shaping up to be a blockbuster month for new listings in India, with expectations of ~$5 billion in IPOs. Notably, the Tata Capital IPO raised ₹15,512 crore, the largest in 2025 so far. Some of the FII inflows may be directly tied to participation in these IPOs or anticipation of liquidity recycling from primary markets into secondary markets. When IPOs succeed and funds return, some capital naturally flows into blue-chips or adjacent equities.

3. Valuations cheaper after earlier correction: The extended FII selling had taken some pressure off valuations. Some key large-caps had corrected and were increasingly seen as attractive entry points for global funds looking for emerging market exposure. When valuations become reasonable relative to global peers, FIIs tend to rotate back.

4. Improved global risk appetite & policy tailwinds: Signs of stabilization in global markets, easing of inflation in the U.S., and expectations of central bank pivots abroad have allowed riskier assets to regain favor. Moreover, international institutions like ADB have urged India to unlock investment through reforms and liberalization measures. Also, as geopolitical and macro uncertainty softens, capital that had been parked on the sidelines is finding its way back.

Risks & Questions: Can the Inflow Trend Sustain?

While the inflows are encouraging, several caveats and risks warrant attention.

* Fragile global backdrop & external shocks: Any resurgence of U.S. rate hikes, renewed inflation, or trade wars could spook foreign investors again. Because FIIs are sensitive to global liquidity cycles, they can quickly reverse course.

* Earnings disappointment & valuation stress: If corporate earnings in India underperform expectations, or input costs and margins are squeezed, the optimism might reverse. The rebound in flows needs to be backed by tangible earnings momentum.

* Currency volatility: The Indian rupee has already seen pressure, dipping to a record low of ₹88.81 per USD on 14 October. Currency depreciation can erode returns for foreign investors, especially if hedging costs rise.

* Role of DIIs & domestic flows: Even though FIIs are making a return, DIIs remain the stabilizing force. In 2025, DIIs have posted significantly larger cumulative inflows relative to FIIs, helping mitigate volatility from external flows. The balance between FII and DII will shape how durable this uptrend is.

* Technical correction potential & volatility: Sharp inflows may trigger short-term reversals or profit booking. The sharpness of the reversal could exacerbate volatility, especially if institutional positioning is heavily skewed.

Implications for Markets & Investors

* Valuation multiple expansion: Renewed foreign capital inflow can support multiple expansion, particularly for mid- and large-cap names. Sectors that had been shunned (like financials, utilities, infrastructure) may see rotation.

* Volatility moderation: Periodic selling pressure from FIIs had contributed to higher volatility in 2025. If inflows are sustained, volatility could recede, providing a more stable environment for institutional and retail investors.

* Rebalancing the influence pendulum: For a long time, FII flows had an outsized impact on market direction. This reversal could re-establish foreign investors as active drivers of returns, reducing the purely domestic bias.

* Strategically selecting sectors & names: Investors may want to tilt toward sectors that are historically favorites of FIIs (financials, large-cap private banks, capital goods) while monitoring undervalued re-rating plays.

Conclusion

The ₹3,000 crore FII inflow over a brief span in October 2025 marks a sharp and welcome shift in investor sentiment. After months of heavy exits, the return indicates that global risk appetite, valuation recalibration, and India’s macro stability are aligning in favor. Yet, sustainability depends on earnings support, global conditions, and currency stability. For now, equities may enjoy a tailwind, but investors must remain alert to rapid reversals in the FII cycle.

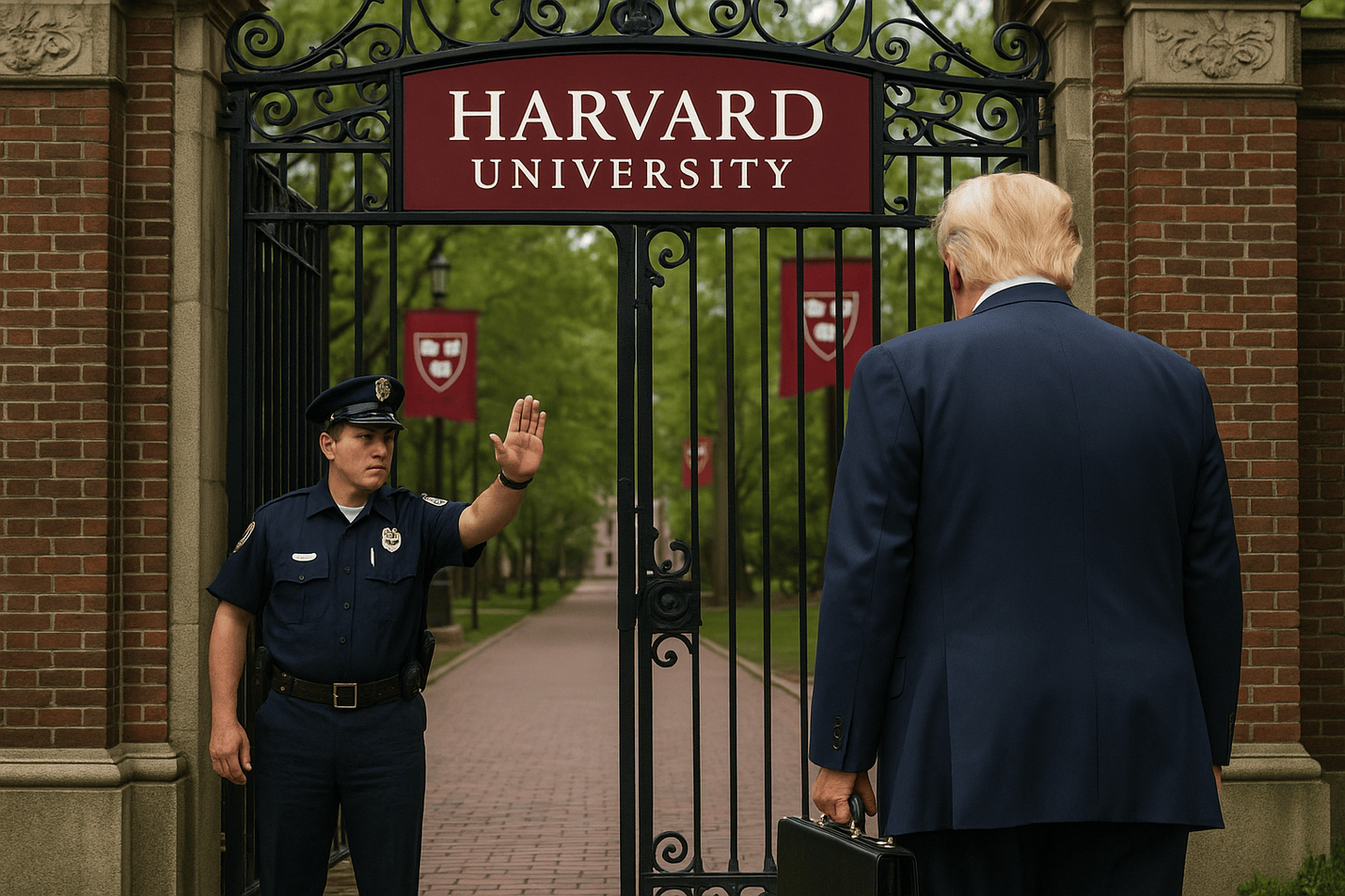

The image added is for representation purposes only

LEAVE A COMMENT

You must be logged in to post a comment.