Lenskart’s IPO: A Clear Vision for India’s Eyewear Future

Lenskart Steps Toward Public Listing

India’s stock market is about to get its first pure-play eyewear listing, with Lenskart gearing up for an IPO that could raise ₹2,150 crore. The offering is designed to give early backers an exit route while channelling fresh funds into expanding company-owned stores.

It’s a milestone headline — but does the business story live up to the excitement? Let’s unpack what’s happening, explore Lenskart’s market position, and see what the road ahead might look like.

A Long-Awaited Move

After recording its first-ever profitable year, Lenskart has filed its Draft Red Herring Prospectus (DRHP) in preparation for going public. The company plans to issue fresh equity worth ₹2,150 crore.

Since its inception, Lenskart has gone through 19 funding rounds, raising about $1.08 billion in total. This IPO will allow some of its earliest investors to cash out while injecting new capital into the business. A significant share of these funds is earmarked for CoCo (company-owned, company-operated) outlets, along with expansion via acquisitions.

What makes this debut particularly noteworthy is that nearly 40% of Lenskart’s revenue already comes from international markets. Unlike most Indian consumer brands focused on domestic dominance, Lenskart is openly chasing global market share — a move that even veteran banker Uday Kotak questioned earlier this year.

The Lenskart Playbook

At first glance, many think of Lenskart as a tech-first brand thanks to its app and website. In reality, the company’s DNA is rooted in physical retail — in India and abroad.

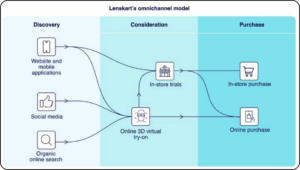

Its operational model is fully vertically integrated: from conceptualising and designing eyewear to manufacturing and direct sales, everything happens in-house. On top of this, Lenskart has adopted an omnichannel approach, blending online reach with offline presence to create a layered customer acquisition strategy.

This combination of control over the value chain and hybrid sales channels gives it a unique edge in an industry where most competitors depend on third-party manufacturing or retail partners. Source: Lenskart Solutions Limited, DRHP

Source: Lenskart Solutions Limited, DRHP

Lenskart’s integration gives it a serious cost edge. No middlemen inflating prices 2.5–4x, and massive scale from selling 27.2 million eyewear units in FY25.

Source: Lenskart Solutions Limited, DRHP

Scaling Smart: How Lenskart Turns Size into Strategy

By operating at a massive scale, Lenskart is able to source frames and lenses at 35–50% lower costs than most competitors. This cost advantage, supported by manufacturing control through facilities in Gurugram, Bhiwadi, and soon Telangana — plus overseas plants in Singapore, the UAE, and a joint venture in China — allows the company to sustain gross margins close to 70%.

But the benefit goes far beyond profitability. Full control over both design and manufacturing gives Lenskart agility — crucial in a category where eyewear doubles as both a medical necessity and a fashion accessory. This integration allows the company to respond quickly to emerging trends, keep products fresh, and strengthen customer stickiness. Evidence? Over 98% of customers make repeat purchases within two years, many also renewing their paid Gold Membership.

The company’s measured approach to international growth further reinforces its base. Instead of rushing into new markets, founder and CEO Peyush Bansal prefers to acquire established players that align with Lenskart’s strengths in India. Today, it operates 656 stores abroad, each chosen with precision, aiming for premium margins in targeted geographies while keeping India as the anchor. This strategy draws parallels to global eyewear leader EssilorLuxottica, which holds about 20% global market share.

A First for Public Investors

With an estimated 25–40% share of India’s organised eyewear market, Lenskart sits well ahead of its nearest competitor. Yet, until now, retail investors had no way to directly invest in a dedicated eyewear business in India. Titan Eye exists, but it’s housed under Titan Company Ltd, where jewellery is the mainstay. Lenskart’s listing changes that — offering a pure-play opportunity in a growing, underpenetrated sector.

The company is financially robust, generating operating cash flow at 1.27 times EBITDA. For investors, this IPO is not just another debut — it represents the market’s first chance to own a focused leader in Indian eyewear.

The Growth Lens

India’s eyewear market is projected to be worth ₹78,800 crore in 2025, expanding at an annual rate of 13.5%. Prescription lenses make up 70% of the market, and demand is set to climb sharply as 62% of the population is expected to suffer from vision issues within five years.

Initially, Lenskart expanded through a franchise-led, asset-light model, which appealed because of quick payback — often just over 10 months, and even shorter in smaller cities. However, strained franchise relationships have prompted a strategic pivot. Now, the company is focusing on expanding company-owned outlets, enhanced with AI-driven tools and remote eye-testing capabilities to boost accessibility.

Final Frame

From a startup to a retail powerhouse with global aspirations, Lenskart has become one of India’s most compelling consumer stories. Whether it evolves into the “EssilorLuxottica of the East” will unfold in time — but for investors, the opportunity to buy into India’s eyewear growth story after 17 years of waiting is finally here.

:

The image added is for representation purposes only