What to do if even after applying for moratorium, the EMI still gets debited

To cushion the economic impact of the outbreak of Covid-19, the Reserve Bank of India (RBI) has announced moratorium on term loans and retail loans. Here, borrowers can defer the EMIs or credit card dues falling between 1st March 2020 to 31st May 2020. While the RBI announcement on three month moratorium will provide breather to borrowers, it might call for credit risks to the lenders.

Refund in case EMI gets deducted from an account:

As the moratorium was announced at the end of March, banking and financial institutions had to tweak their systems accordingly in a short duration. Due to this even after opting for moratorium, it is possible the same has been debited from the borrowers account, as most if not all use Electronic Clearing Facility(ECS). But you do not have to worry!

Customers opting for moratorium will see refunds in to their accounts if the EMIs stand auto debited. The process is further simplified by either emailing an application form or reaching out to the bank branches to apply for the moratorium. Most if not all banks have started messaging to those who opted for moratorium and informing them about the refunds.

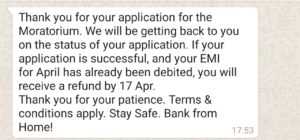

Banks customer applying for the moratorium will receive a text similar to the image below.

Customers have the choice to choose whether they would prefer EMI deduction or deferment.

Equity Right strongly advises the borrowers to ensure any confirmation they have with the bank regarding the moratorium shall be kept handy.

LEAVE A COMMENT

You must be logged in to post a comment.