RBL Bank Q4 Results

Executive Summary

Bank continued to maintain strong capital , stable asset quality. A key development in FY2025 was the strategic adoption of revised RBI investment guidelines, which enhanced the bank’s net worth and accounting clarity.

Key Financial Highlights (Standalone)

| Particulars (₹ in crore) | Q4 FY25 | Q3 FY25 | Q4 FY24 | FY25 | FY24 |

| Interest Earned | 3,476 | 3,536 | 3,339 | 14,039 | 12,394 |

| Other Income | 1,000 | 1,073 | 875 | 3,806 | 3,043 |

| Total Income | 4,476 | 4,610 | 4,215 | 17,845 | 15,437 |

| Operating Profit (before prov.) | 861 | 997 | 887 | 3,627 | 3,030 |

| Provisions (other than tax) | 785 | 1,189 | 414 | 2,959 | 1,778 |

| Net Profit | 69 | 33 | 353 | 695 | 1,168 |

| Capital Adequacy Ratio (Basel III) | 15.54% | – | 16.18% | 15.54% | 16.18% |

| Gross NPA (%) | 2.60% | 2.92% | 2.65% | 2.60% | 2.65% |

| Net NPA (%) | 0.29% | 0.53% | 0.74% | 0.29% | 0.74% |

| Return on Assets (RoA) | 0.20% | 0.09% | 1.08% | 0.51% | 0.96% |

Segment Performance Breakdown

Retail banking contributed ₹1,613 crore in revenue, dominating the segment mix. Corporate banking and treasury brought in ₹672 crore and ₹975 crore respectively. Retail banking faced losses due to heightened provisioning from the JLG portfolio.

Strategic Accounting Changes (FY25)

The bank adopted RBI’s revised investment guidelines from April 2024, resulting in a ₹75.58 crore transfer to general reserve and fair value adjustment across AFS and FVTPL portfolios, enhancing transparency.

Cash Flow Summary (Standalone)

Operating cash flow was negative at ₹84.18 crore due to growth in advances. Cash and cash equivalents ended at ₹1,251.68 crore, down from ₹1,412.46 crore a year ago.

Consolidated View

Consolidated net profit was ₹71.71 crore for FY2025. The bank’s net worth rose to ₹1,506 crore, and deposits closed at ₹11,093 crore, backed by consistent credit growth and stable capital ratios.

VIII. Capital and Shareholder Updates

RBL declared a ₹1 per share dividend. The bank allotted 2.78 million shares under ESOP schemes during the year, reflecting long-term talent investment.

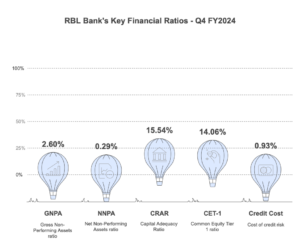

Key Financial Ratios

Earnings per Share stood at ₹11.45 (basic) and ₹11.40 (diluted) on a standalone basis. Debt-equity ratio stood 0.88 and total debt to total assets was at 9.36%.

Outlook and Conclusion

The conservative provisioning approach, improved asset quality, and regulatory compliance put the bank on a solid foundation for sustainable growth into FY2026.

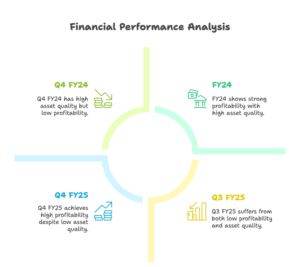

Market Insights on Q4 FY2024 Performance

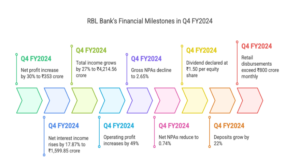

In Q4 FY2024, RBL Bank’s financial performance received considerable media attention, highlighting its strategic gains and sound fundamentals. The bank recorded a net profit of ₹353 crore, a 30% year-on-year increase, driven by a solid 17.87% rise in net interest income (NII), which stood at ₹1,599.85 crore. Total income for the quarter grew by 27%, reaching ₹4,214.56 crore, while operating profit rose 49% from the previous year.

Improvement in asset quality was evident with gross NPAs declining to 2.65% and net NPAs reducing to 0.74%. Net interest margin (NIM) was maintained at a healthy 5.45%, indicating efficient interest spread management.

The bank declared a dividend of ₹1.50 per equity share for FY2024, reflecting its strong financial position and shareholder commitment. A 22% year-on-year growth in deposits further enabled strong credit disbursement, particularly in the retail segment, where monthly disbursements exceeded ₹800 crore, encompassing business, home, and rural vehicle loans.

Challenges were also noted, with a slight increase in asset slippages to 0.56%, primarily from unsecured and microfinance segments. Despite this, RBL’s prudent provisioning policies ensured the bottom line remained protected.

Overall, media coverage emphasized RBL Bank’s solid execution and steady recovery in FY2024, reaffirming its resilience and readiness to navigate upcoming market dynamics.

Investor Presentation Highlights – Q4 & FY2025

The investor presentation for Q4 & FY2025 offered a comprehensive view of RBL Bank’s operational resilience, strategic focus, and performance outcomes. Despite reporting a moderate net profit of ₹69 crore in Q4 FY25, the bank made a 100% provision on gross NPAs in its JLG (Joint Liability Group) portfolio, demonstrating a prudent approach to risk management.

Net Interest Income (NII) for the quarter declined by 2% year-on-year to ₹1,563 crore, with Net Interest Margin (NIM) at 4.89%. On the other hand, the bank recorded a 14% growth in other income to ₹1,000 crore, aided by a 17% increase in core fee income. Operating profit stood at ₹861 crore.

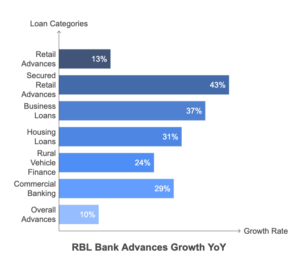

Growth was primarily retail-led:

- Retail advances grew 13% YoYto ₹55,703 crore.

- Secured retail advances surged 43% YoY, led by:

- Business loans: ↑ 37%

- Housing loans: ↑ 31%

- Rural vehicle finance: ↑ 24%

- Commercial banking(mid-corporates/SME) within wholesale banking grew by a notable 29% YoY.

- Overall advances reached ₹92,618 crore (↑10% YoY).

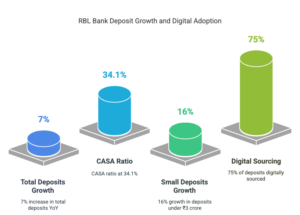

Deposit traction and granularity improved:

Deposit traction and granularity improved:

- Total deposits grew 7% YoY to ₹110,944 crore.

- CASA ratio stood at 34.1%.

- Deposits under ₹3 crore grew 16% YoY and now represent ~50% of total deposits.

- Over 75% of fixed deposits and savings accounts were digitally sourced, highlighting strong digital adoption.

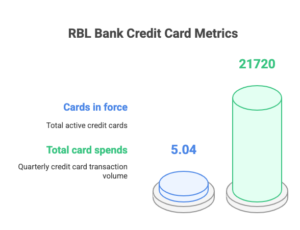

Credit cards remained a high-volume portfolio:

- Cards in force: 5.04 million

- Total card spends: ₹21,720 crore (Q4)

- Receivables remained stable, with portfolio expansion outside Tier-1 cities.

Asset Quality & Capital:

- GNPA improved to 2.60% (↓32 bps QoQ)

- NNPA declined to 0.29% (↓24 bps QoQ)

- Capital Adequacy Ratio (CRAR): 15.54%

- CET-1 ratio: 14.06%

- Credit cost for Q4 was 93 bps.

Digital & Tech Advancements:

- 5 million customers use RBL’s mobile apps.

- Daily API calls exceed 1 million, with live end-to-end onboarding for open banking clients.

- Key features launched include WhatsApp-based account opening, assisted journeys, and digital FD overdraft access.

- 86% of recurring deposits and 66% of fixed deposits are now booked digitally.

Sustainability & ESG Focus:

- Voluntary climate risk policies adopted; target to eliminate coal exposure by FY2034.

- Strong focus on financial literacy for rural women.

- Recognized as India’s Best Bank for CSR (AsiaMoney) and awarded for technology innovation by IBA.

The image added is for representation purposes only